what is the salt deduction repeal

Our new business reporter Daniel Munoz explains why and lets you know what your Congressional representatives are doing to remove the 10000 cap on those deductions. Only about 9 percent of households would benefit from repeal of the Tax Cuts and Jobs Acts TCJA 10000 cap on.

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

These skeptical Democrats are right.

. Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT. A group of Blue State Democrats has insisted on some SALT fix as their price for supporting Bidens Build Back Better plan. The SALT deduction is one tool for redistributing tax revenue but most working people dont have access to it because they dont itemize.

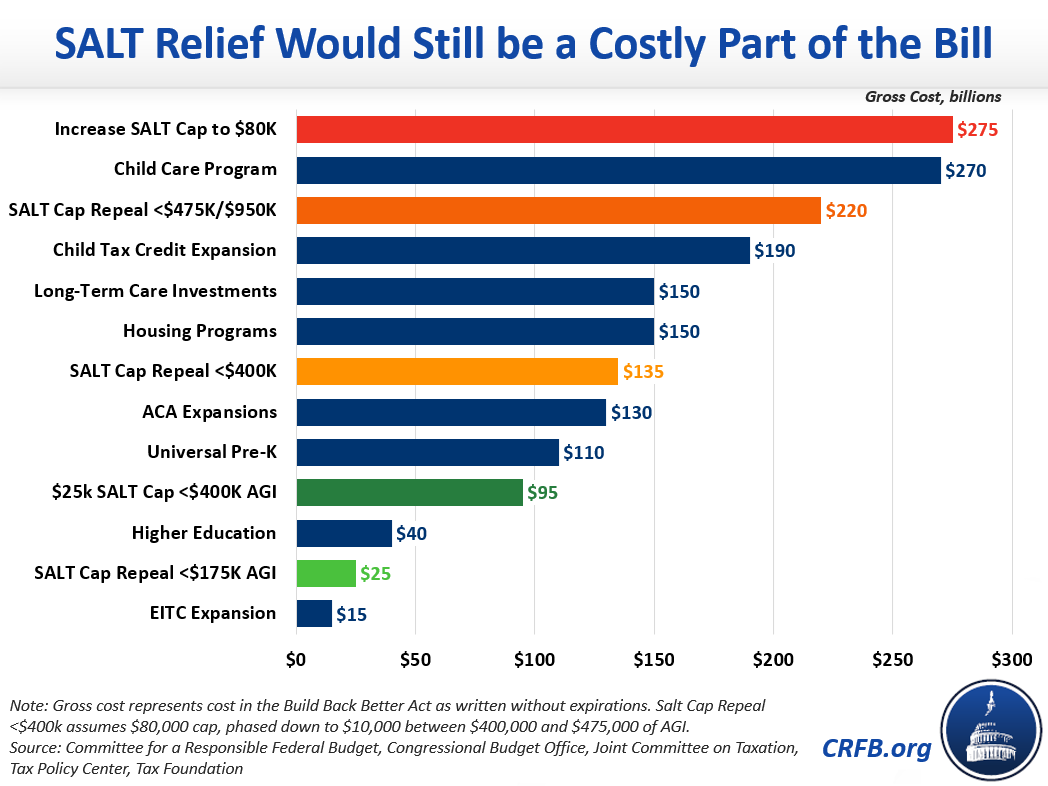

The BBBA would raise the SALT deduction limitation from 10000 per year to 80000 per year from 2021 through 2030 lower it to 10000 in 2031 and then eliminate it. This Bill Could Give You a 60000 Tax Deduction. Starting with the 2018 tax year the maximum SALT deduction available was 10000.

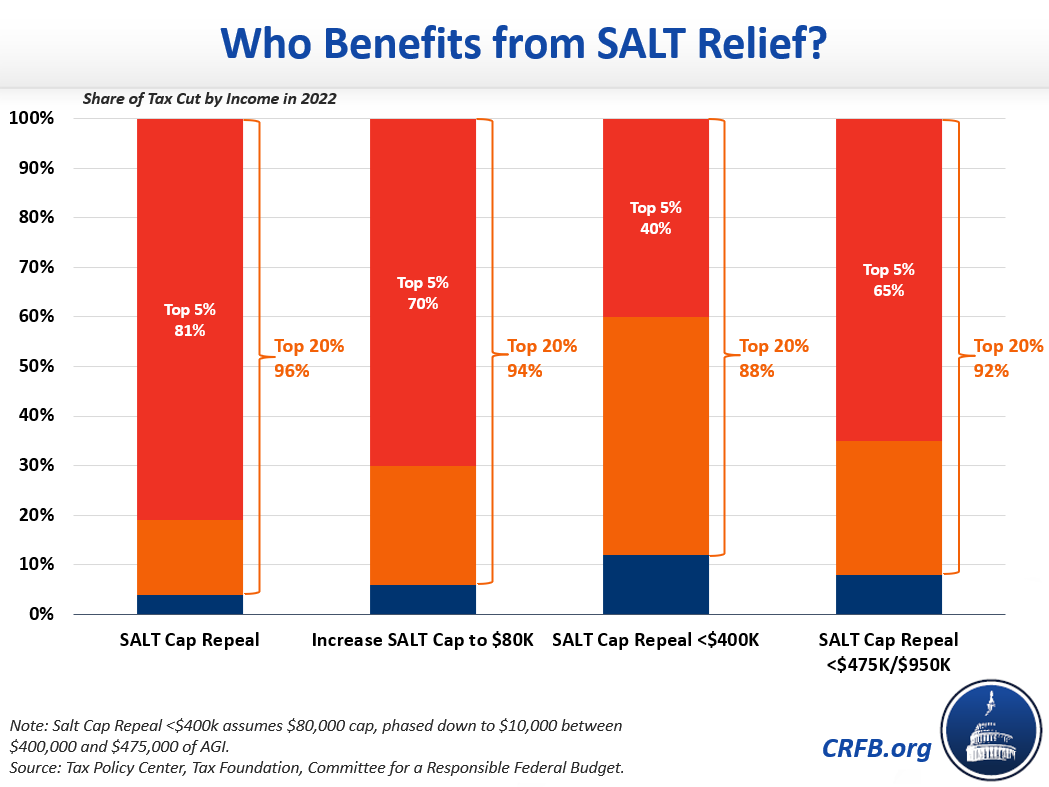

The bill would cut taxes sharply for the next five years by increasing the value of the deduction but it would mean higher taxes in the following five years than if. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000. Almost all 96 percent of the benef its of SALT cap repeal would go to the top quintile giving an average tax cut of 2640.

Leading advocates for repealing the cap praised the development. This significantly increases the boundary that put a cap on the SALT deduction at 10000 with the Tax Cuts and Jobs Act of 2017. As a result the percentage of taxpayers claiming the deduction fell by nearly two-thirds while the average amount claimed fell by 80 percent.

A key component of the tax reform bill passed under President Trump in 2017 capped the amount of state and local taxes a person could deduct from their federal income taxes at 10000. 57 percent would benefit the. Unfortunately it doesnt look like you will be getting any more federal relief on your state and local income taxes otherwise known as SALT.

However nearly 20 states now offer a workaround that allows. However for tax years 2018 through 2025 the TCJA capped the SALT deduction at 10000 for single taxpayers and couples filing jointly limiting its value for tax filers. Doubling the cap to 20000 would remove the marriage penalty but it would reduce federal revenue.

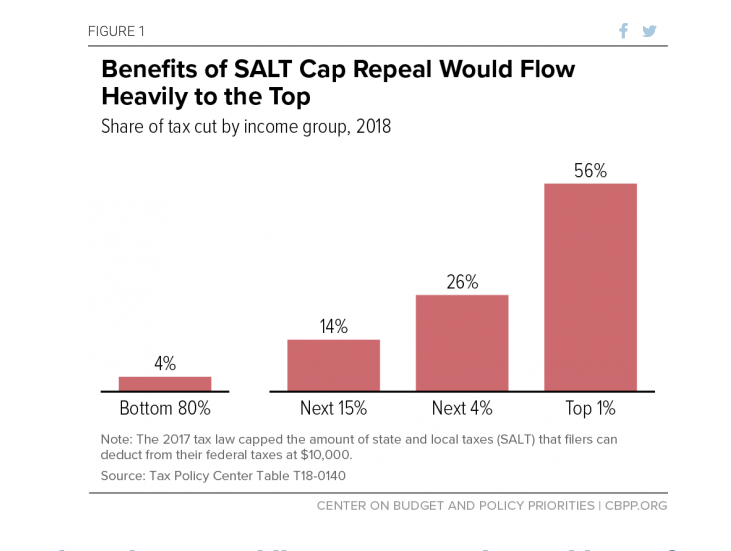

Two single filers may each take up to 10000 in SALT deductions but jointly filing means only one 10000 deduction can be taken. Americans who rely on the state and local tax SALT deduction at. There is widespread recognition across the political spectrum that the vast majority of the SALT deduction benefits the wealthy and a repeal of the cap on the SALT deduction would amount to a tax break for the wealthiest Americans.

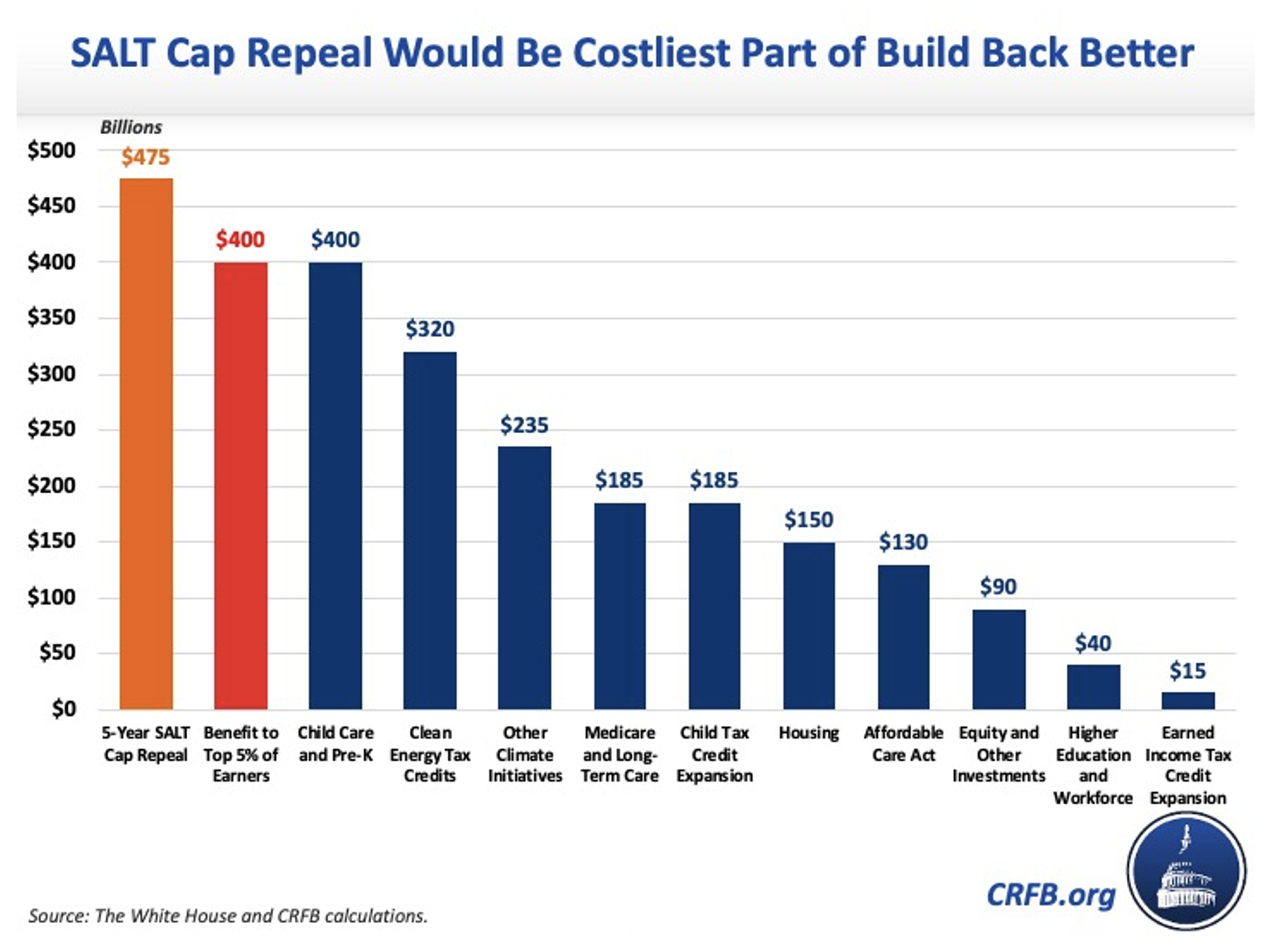

Even a temporary repeal would be costly and. House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030. Repealing the SALT deduction cap is a top priority for a number of House Democrats in high-tax states such as New York and New Jersey.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. A straight repeal of the cap for every household that claims the deduction would siphon huge amounts of revenue from the federal government. 52 rows The state and local tax deduction commonly called the SALT deduction is a federal deduction that allows you to deduct the amount you pay in taxes to your state or local governments.

About 90 billion per year according to budget experts. A two-year SALT cap repeal. The House on Thursday passed a bill to temporarily repeal the GOP tax laws cap on the state and local tax SALT deduction advancing a key priority for many Democrats before leaving Washington.

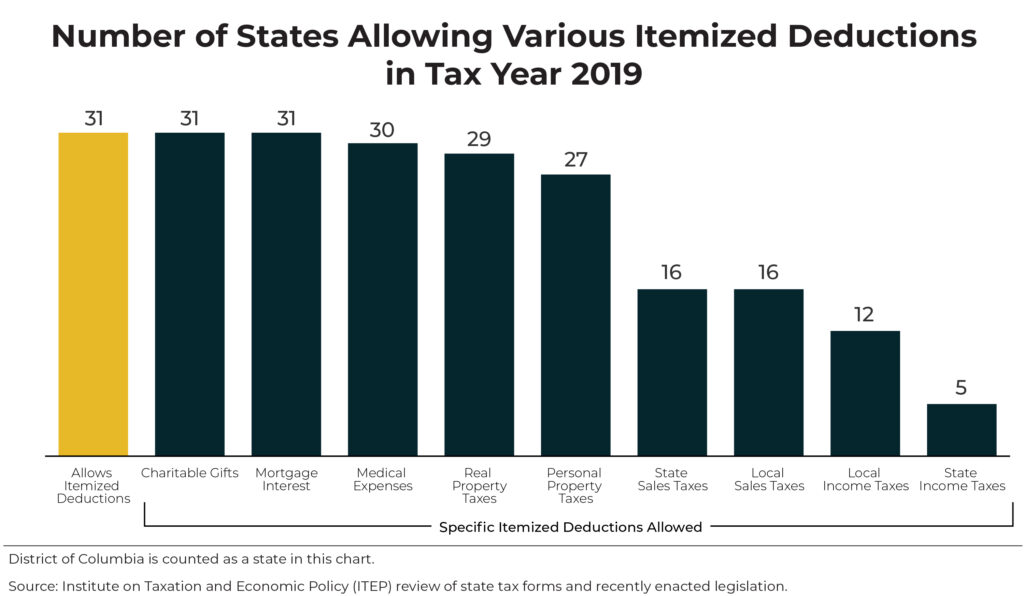

The SALT Deduction allows taxpayers who choose to itemize their deductions usually the richest Americans to include state and local taxes to offset their federal tax liability. Restoring the full SALT deduction would cost the US. Specifically the SALT deduction can include the amounts you paid on property and real estate taxes personal property taxes such as for cars and boats and either local income.

Democrats reportedly are considering a plan to repeal the 2017 cap on the state and local tax SALT deduction for 2022 and 2023 only. Even if lawmakers repealed the SALT cap exclusively for households earning below 500000 less than 3 percent of the benefit would go to the lowest earning 60. A new bill seeks to repeal the 10000 cap on state and local tax deductions.

Im proud to launch the bipartisan SALT Caucus to repeal the deduction cap A critical component of our overall economic recovery must be the repeal of the state and local tax deduction cap that was imposed by the 2017 tax law. Because of political polarization there are few Republicans in high-tax states that would be affected by SALT deduction repeal although of the 13 Republican House members who voted against the bill 12 were from either New York New Jersey or California and they cited the SALT deduction repeal as the reason. Treasury 887 billion in lost revenue for 2021 alone according to the Joint Committee on Taxation.

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

States Can Make Their Tax Systems Less Regressive By Reforming Or Repealing Itemized Deductions Itep

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

Eliminating The Salt Cap To Help The Rich Doesn T Fight Coronavirus Ways And Means Republicans

Biden Officials Push For Progress On Infrastructure Plan By Memorial Day Youtube Memorial Day Progress Memories

What Is Salt Tax Deduction Mansion Global

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Dems Hike Taxes On Middle Class To Pay For 475b Salt Tax Shelter For Rich Ways And Means Republicans

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It